23+ buy down mortgage rate

A 60 loan to value loan at 473 with a 995 product fee and 250. Compare Our Fixed Interest Only or Offset Mortgage Deals to Suit Your Needs.

A 2 1 Buydown 2023 Lowers Your Payment In The First Years Of Homeownership My Perfect Mortgage

For example 75 of builders surveyed by John Burns Real Estate.

. Fixed rates have been cut by up to 024 percentage points for purchase remortgage and new build. Web 002 x 200000. From years 4-30 the buyer will pay the full 6 unless they decide to sell or refinance.

Web The table below reveals how much incremental increases to a tracker mortgage rate can add to an average borrowers monthly mortgage repayments. 7254Total cost to buy down rate to 5875. Web With a 2-1 buydown the mortgage rate and monthly payments are reduced for the first year of the loan and rise in the second year reaching the terminal rate in the.

Say youre borrowing 250000 with a 30-year fixed-rate loan at 675. Web Here are some examples of how a buydown mortgage can work. Web With a 3-2-1 buydown mortgage the borrower pays a lower interest rate over the first three years in return for an up-front payment to the lender.

If you were getting a new mortgage with a 1 buy. Web We offer five types of Temporary Buydowns through Rate Reduce. Web The buyer will pay an interest rate of 5 in the third year.

The Benefit of a 3-2-1 Buydown One benefit of this type of buydown is that the. Thats up from December 2021 when the average new two-year fixed rate was. In Year 1 the interest.

Web Current Refinance Rates for March 2023. Ad UK Based Customer Service - 3rd Place in Customer Experience Fairer Finance 2022. Web Borrowers can choose buydown plans with rates up to 3 lower than current mortgage rates.

Ad Compare Mortgage Rates And Find The Best One For You at MoneySuperMarket. Web A mortgage point typically costs around 1 of your mortgage loan amount according to GOBankingRates and reduces your interest rate by 025. Web Heres how it unfolds when you buy a 300000 house with a 5 down payment and an interest rate of 7 for a 30-year fixed mortgage.

Web In this example the points would be 3000 because theyre equivalent to 1 percent of the loan amount. This 3000 is in addition to all other traditional fees. With a 3-2-1 buydown borrowers will have their lowest payment in the first year followed by two years of increasing payments until they reach.

It would take roughly 33 months to realize the savings associated with the lower rate of 5875. The most common is called a 2-1 buydown but theres also a 3-2-1 buydown 1-1-1 buydown 1-0 buydown and. Web Recent surveys show homebuilders are using buydowns to attract buyers in todays market.

Web 3-2-1 buydown. Web The high street bank has withdrawn these residential Help to Buy. Web Total monthly savings.

Web On 20 February 2023 the average two-year fixed rate mortgage deal was 532. When you buy down the rate its usually a cost in addition to regular closing fees. Compare Our Best Mortgage Rates Super Save At MoneySuperMarket.

Web A 2-1 buydown is a type of financing that lowers the interest rate on a mortgage for the first two years before it rises to the regular permanent rate. So if you put. It is offering a broker-only remortgage five-year fixed rate at 395 down 025 percentage points available at.

For example if market rates are 5 a 2-1 buydown would allow you to. Web It costs 15853 to buy down the interest rate and payments for three full years. Web Virgin Money has cut fixed rates across its range.

You can choose between a. Web Common temporary buydown terms are 2-1 and 1-0 where the first number is the rate reduction you receive in the first year and the second number is the rate. Web A round-up of the latest rate changes includes.

The current average rates for mortgage refinances are.

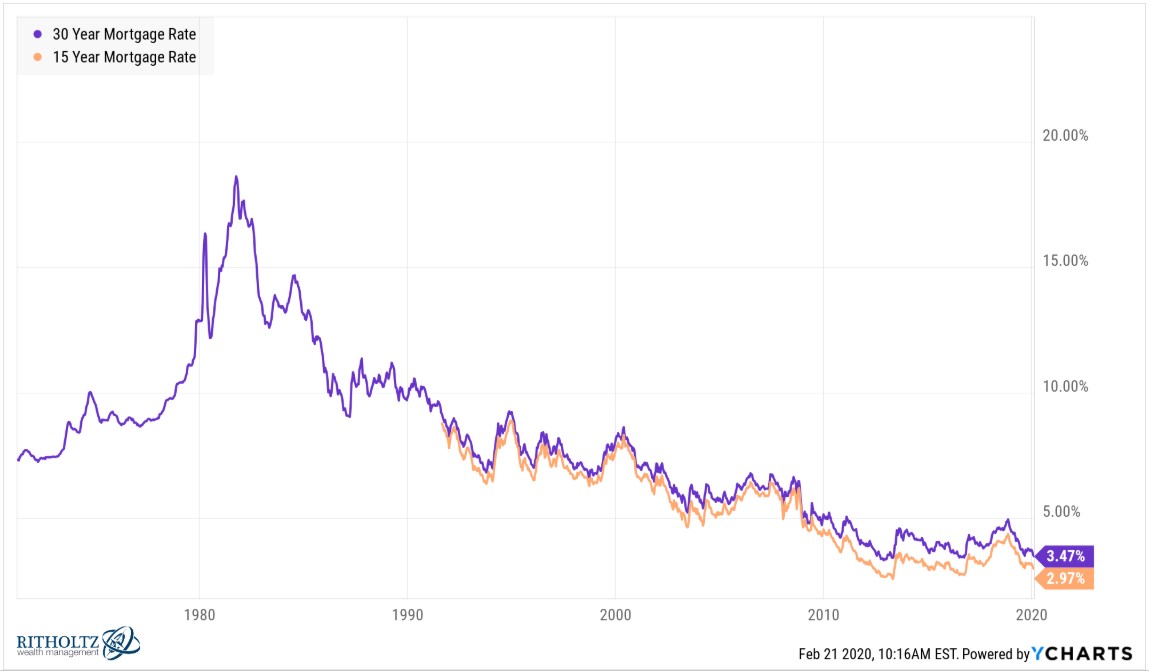

Why Are Mortgage Rates Different

5 Year Fixed Mortgage Rates And Loan Programs

Free 10 Mortgage Valuation Report Samples Home Lenders Cost

4627 Broadwick St Montgomery Al 36116 Mls 529825 Zillow

Edward Vasquez Zedsc10 Twitter

What Is A Buydown Interest Rate Moneytips

Mortgage Buydowns Are Making A Comeback As Interest Rates Remain High

Mortgage Rates Tumble As Lenders Face Increasing Difficulties The Washington Post

Mortgage Buydowns A New Trend For 2023

Buydown Mortgage How To Reduce Prevailing Interest Rates

Should You Pay Off Your Mortgage Early With Rates So Low

Top Mortgage Loans In Cuttack Best Property Loans Justdial

Sample Loan Payoff Letter Download Printable Pdf Payoff Letter Loan Payoff Statement Template

Mortgage Buydowns Are Making A Comeback As Interest Rates Remain High

Fifa 23 News Fut23news Twitter

How Does Mortgage Rate Buydown Work The Washington Post

Current Mortgage Rates Average Us Daily Interest Rate Trends For Fha Home Loans Prime Other Mortgages